Whew, you made it! You have found your dream home, made an offer, stressed through the contract stage, and waited out the home

inspection. You’re in the closing process! Now what? The closing process typically takes about 30 days to complete. Using the Patten Proven Process, Patten Title takes the guesswork and title worries away from buyers, sellers, and real estate professionals. We ensure accuracy and commitment from contract execution and earnest money receipt through title plant and examination processes. After the keys are delivered to the new homeowner, Patten Title ensures that the ownership change is filed with the tax office and appraisal district. We then deliver the new title electronically so that necessary paperwork is easy to access whenever needed. We have seen our fair share of closings and can help answer a few frequently asked questions you may have about what to expect when closing.

1. WHO COMES TO THE CLOSING?

There will be several full seats at the closing table. You may or may not see the seller, who is not required to come but could choose to send a lawyer or other legal representation. You’ll also see:

-Your (Buyer’s) real estate agent

-The Seller’s real estate agent

-Closing agent or Escrow Officer

-Lender(s)

-Attorneys

2. WHERE IS THE “CLOSING TABLE”?

Your escrow officer or title company often has conference rooms big enough to host all of these people, and signing the legal papers for a loan and the property transfer can take time. The “closing table” is usually a territory-neutral location with space for everyone that is also comfortable enough for all of the paperwork to be signed easily.

About a week before the final closing, you’ll be notified of your closing location and time so that you can prepare your schedule. Your closing will likely be in the morning or just after lunch; escrow officers avoid scheduling closings too late in the day because bank wire transfers often shut off near 4 p.m.

3. I’M THE BUYER, BUT SOMETHING CAME UP AND I CAN’T BE AT THE CLOSING!

If you think that there may be a reason you aren’t able to attend the closing, talk to your real estate agent in advance. They can help you designate and create a Power of Attorney who can be present on your behalf.

Your real estate agent can also help you set up a meeting with a notary who will be present as you sign the documents and send them overnight to your escrow officer. All of this will likely come at an extra cost, so it is in your best interest to be at the closing table in person.

4. WHAT HAPPENS DURING THE CLOSING PROCESS?

Buyers have lots of paperwork to sign to be able to finalize the purchase of a property. This usually entails property transfer documents plus any loan paperwork. If there are multiple buyers on a property (for instance, you and a spouse on a home or you and a partner on an investment property), signing all that paperwork is a lengthy process.

The paperwork process comes in two parts: the title transfer and paying for the property. It will go much quicker if you don’t require a loan for your new home. If you have secured a loan through a trusted lender, there is additional paperwork to sign.

Don’t rush; take your time to read all of the documents. Many will be explained to you, so you know what you’re signing (the deed, the loan paperwork, disclosure forms, etc.).

5. WHAT IS THE PAYMENT PROCESS?

You’ve already paid earnest money when you started the contract to buy the property. But you’re not done paying yet. Before closing day, your lender will provide you with a figure that includes:

-Closing costs

-Down payment for your home

-Any prepaid interest

-Required property taxes

-Prepaid insurance for your home

You can complete a secure wire transfer for this total, or you’ll need to bring a cashier’s check. Patten Title conveniently uses an app called ZOCCAM to help with instant and secure transfers.

6. WHAT DO I NEED TO BRING WITH ME?

Whether you are the buyer or seller, you’ll need to ensure you have your ID. Also, bring any payments required, and your lender may require proof that you’ve secured homeowners insurance.

Ask your real estate agent if there are other papers you’ll need to provide — such as the closing or a copy of the purchase agreement — or if copies of those will already be on hand.

7. I’M BUYING A NEW HOME AND SELLING MY HOUSE AT THE SAME TIME. CAN BOTH CLOSINGS HAPPEN TOGETHER?

Simultaneous closings can happen, but they get complicated. Look back at the list of people who must be at the closing, then double it. Your title agents may not be the same, your lender agents may not be the same, and these are more schedules you have to work around.

Simultaneous closings sound like a great idea because you don’t want to be without a home. Yet, it might be easier to schedule them on the same day instead of at the same time. Consider a backup plan just in case, like a local Airbnb, short-term rental or hotel to stay in while you’re waiting to close on a new property.

8. WHAT SHOULD I DO WITH ALL OF THIS PAPERWORK?

As the buyer, you might come home with copies of your loan paperwork, and your final title will arrive in the mail within 30 days. Some documents, like your closing disclosure, will be necessary to provide to an accountant or tax professional to prepare your taxes.

You can either keep this paperwork with your personal documents at home, so that you have a copy on file in case there are questions, or you can ask to have them digitized and store them in a secure cloud system. Patten Title uses a system called Qualia, that allows you to log in to access your digital documents at any time, should you need them.

9. WHEN DO I GET THE KEYS TO MY NEW HOME?

While the closing might happen in your title company’s office, your escrow officer doesn’t necessarily have your keys. Your keys will most often transfer between real estate agents at the end of the closing process. In case the seller doesn’t attend the closing, make sure you keep their real estate agent’s contact information should any concerns arise while moving in.

In some cases, the seller can negotiate occupancy in the home after the closing date. If that has happened with your property purchase, you may receive “rent” while the seller remains in your home, and they will turn over your keys after they move out.

10. NOW THAT I HAVE MY KEYS, WHEN CAN I START TO MOVE IN?

You can move in once your new home has been cleared of the previous owner’s items. However, a lot can go wrong at or just before closing day. Because of this, it isn’t recommended to pull up to closing with the movers waiting outside.

Consider scheduling your move-in date a few days after your closing day, just in case any concerns need to be addressed before the final papers are signed.

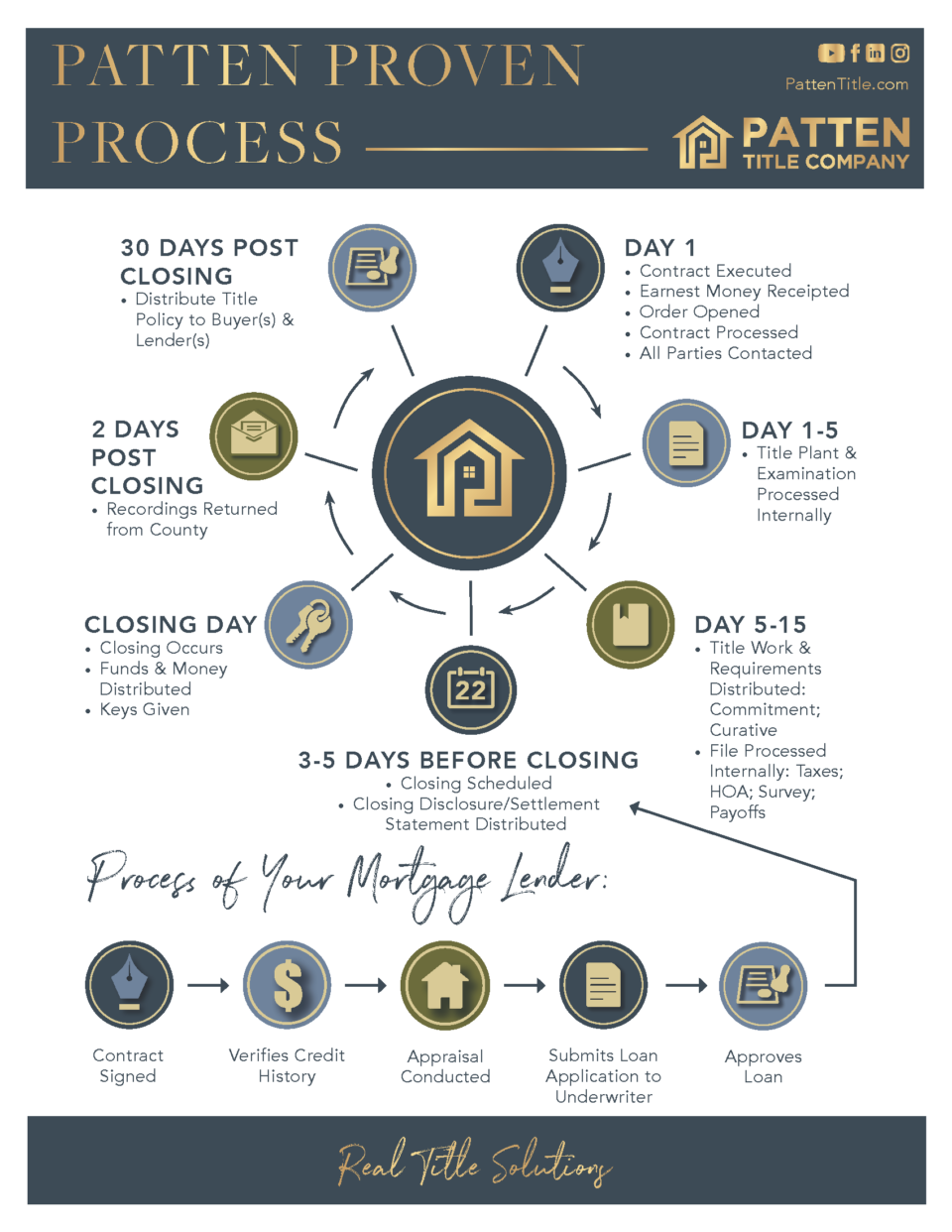

The Patten Proven Process lays out what you can expect the closing process with Patten Title to look like.

Your title company is essential in your real estate purchase, whether this is your first home, your vacation bungalow or your third commercial complex.

Patten Title has perfected real title solutions to help you confidently move from a processed contract to closing day. Our Patten Proven Process eases buyers, sellers, and real estate professionals through the property closing to an accurate title for all parties.

DAY 1

WHAT’S HAPPENING AT PATTEN TITLE:

- Contract Executed

- Earnest Money Receipted

- Order Opened

- Contract Processed

- All Parties Contacted

WHAT IT MEANS FOR YOU:

When you are “in escrow” or in the “contract” status of purchasing a property, the buyer and seller will have signed a promissory contract that includes how much the buyer plans to pay for the property plus any contingencies. That’s when Patten Title gets to work. We have opened an order for a title examination, received the earnest money and processed the contract. We also ensure that all parties are aware of their roles in the closing process.

DAY 1 – 5

WHAT’S HAPPENING AT PATTEN TITLE:

- Title Plant & Examination Processed Internally

WHAT IT MEANS FOR YOU:

A title plant is a database of all records indexed geographically. During a title search, we access our title plant to ensure we have the most up-to-date legal information about the property. By starting with the title plant, we can check to make sure that there are no outstanding actions on the title and that it is as accurate as possible.

DAY 5 – 15

WHAT’S HAPPENING AT PATTEN TITLE:

- Title Work & Requirements Distributed: Commitment; Curative

- File Processed Internally: Taxes; HOA; Survey; Payoffs

WHAT IT MEANS FOR YOU:

Patten Title is processing the title claim and verifying with local authorities that there are no tax liens or HOA fees due, that the survey has been completed and that the title information is accurate. Patten also searches records like wills and divorce settlements, paving assessments, and outstanding mortgage documents to ensure that the property and title information is secure. We’ll alert the necessary parties right away if any outstanding irregularities are discovered. The escrow officer prepares a report for review and sends it out ahead of closing day.

3 – 5 DAYS BEFORE CLOSING

WHAT’S HAPPENING AT PATTEN TITLE:

- Closing Scheduled

- Closing Disclosure/Settlement

- Statement Distributed

WHAT IT MEANS FOR YOU:

Your escrow officer will reach out to schedule the property closing, bringing together all of the necessary parties, including real estate professionals, lawyers, the buyer, and the seller. Patten Title draws up the closing documents, such as the disclosure and settlement, to be signed at the closing. The escrow officer will also review the instructions for the new and old lenders, ensuring that everything is in order before any money is exchanged.

CLOSING DAY

WHAT’S HAPPENING AT PATTEN TITLE:

- Closing Occurs

- Funds & Money Distributed

- Keys Given

WHAT IT MEANS FOR YOU:

Welcome to the closing table! During closing, part of your escrow officer’s job is to make sure that outstanding loans on the property are paid off, and that money is dispersed according to the settlement instructions. Meanwhile, the buyer and seller are signing paperwork for the property and loans. Then, you (the buyer) receives your keys!

2 DAYS AFTER CLOSING

WHAT’S HAPPENING AT PATTEN TITLE:

- Recordings Returned from County

WHAT IT MEANS FOR YOU:

The new information about the title can now be refreshed in the Patten Title system and with the county. This step in the process helps to trigger the ownership change within the tax office and appraisal district. Patten Title ensures that the necessary paperwork is filed and that the title is updated accurately.

30 DAYS AFTER CLOSING

WHAT’S HAPPENING AT PATTEN TITLE:

- Distribute Title Policy to Buyer(s) & Lender(s)

WHAT IT MEANS FOR YOU:

Patten Title sends the updated title policy to the new property owner and the mortgage lenders. Why do the lenders need the title policy? While the property is titled under the name of the new property owners, the mortgage lender technically “owns” the property until the mortgage is paid off. The lender receives a copy of the title policy just as the buyer does in case there are any issues with the title. These copies of the title are delivered electronically for ease of access and reference.